30+ Debt to income ratio for house

You must earn an after-tax income of at least 1000 per month to be eligible. After youve set a fixed income-to-rent ratio consider the 503020 rule to round out your budget.

If Someone Took The Us Debt To Income Ratio And Made A Percentage Comparison To A Household Budget Of 80 000 What Would The Numbers Be Quora

When lenders evaluate your mortgage application they calculate your debt-to-income ratio.

. Your mortgage property taxes and homeowners insurance is 2000. Lenders look at this number to see how much additional debt you can take on. This is important because it can have a big impact on your qualifying debt-to-income ratio DTI.

Debt-To-Income Ratio - DTI. The debt-to-income ratio is an underwriting guideline that looks at the relationship between your gross monthly income and your major monthly debts giving VA lenders an insight into your purchasing power and your ability to repay debt. 10X Your Annual Salary Life Insurance Ratio.

Your debt-to-income ratio is 33. August 30 2022 Buying a house can be a complex process so we broke it down for you. Take the first step toward the right mortgage.

To find your true income basis for a personalized debt-to-income calculation youd subtract 13500 from 70000 then add back 2200. There are two kinds of DTI ratios front-end and back-end which are typically shown as a percentage like 3643. A debt-to-income ratio is the percentage of gross monthly income that goes toward paying debts and is used by lenders to measure your ability to manage monthly payments and repay the money borrowed.

For your convenience we list current Boydton mortgage rates to help homebuyers estimate their monthly payments find local lenders. 20-30-50 Budgeting Ratio. Divide 900 by 3000 to get 30 then multiply that by 100 to get 30.

This percentage is known as the back-end ratio or your debt-to-income DTI ratio. Monthly debt payments monthly gross income X 100 DTI ratio For example your income is 10000 per month. When youre buying a house your debt-to-income ratio influences the size of the loan and the interest rate youll qualify for.

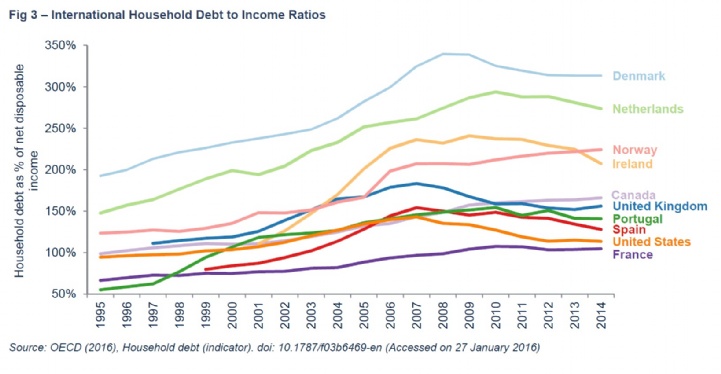

This means your DTI is 30. The process of buying a house after a divorce or while legally separating from your spouse can be tricky. Houshold debt is defined as all liabilities of households including non-profit institutions serving households that require payments of interest or principal by households to the creditors at a fixed dates in the future.

The principle is pretty simple. A low debt-to-income ratio demonstrates a good balance between debt and income. The indicator is measured as a percentage of net household disposable income.

This includes credit cards car loans utility. Please cite this indicator as. The United States Government Debt is estimated to have reached 13720 percent of the countrys Gross Domestic Product in 2021.

The budgeting ratio says the order is important. The debt-to-income ratio is one. 28 of your income will go to your mortgage payment and 36 to all your other household debt.

Use this to figure your debt to income ratio. And mortgage lenders will often have in-house caps on DTI ratio that can vary depending on the borrowers. According to this popular budgeting rule 50 percent of your income goes to essentials 30 percent goes to non-essential personal expenses and the remaining 20 percent goes to savings and investments.

A back end debt to income ratio greater than or equal to 40 is generally viewed as an indicator you are a high risk borrower. 30-Year Fixed 15-Year Fixed FHA Loan VA Loan USDA Loan Jumbo Loan YOURgage. The loans have repayment terms of three to 72 months.

But theres more to this ratio than meets the eye. The 2836 rule is an addendum to the 28 rule. This page provides - United States.

Most responsible lenders follow a 36 percent back-end DTI ratio model unless there are compensating factors. 30 should be the. This is your monthly debt payments divided by your monthly gross income.

Nearly every American carries some kind of debt whether theyre paying for a house. The debt-to-income DTI ratio is a personal finance measure that compares an individuals debt payment to his or her overall income. 58700 annual income or approximately 4892 per month.

The amount you spend on housing should not exceed 36 of your gross monthly pay or 28 of your gross income plus all other monthly debt payments. Figure Out How Much You Can Afford. Adults aged 18-plus who carry debt 30 of their monthly income on.

Save 25X Your Current Income Retirement Savings Ratio. 20 should be immediately saved goals or retirement or put towards paying down debt. Government Debt to GDP in the United States averaged 6454 percent of GDP from 1940 until 2021 reaching an all time high of 13720 percent of GDP in 2021 and a record low of 3180 percent of GDP in 1981.

In general the lower the percentage the better the chance you will be able to get the loan or line of credit you want. Age X Pretax Income 10 Net Worth Ratio. As a reminder gross income refers to the amount of money you make before deducting any withholdings from your paycheck.

Calculate Your Debt to Income Ratio.

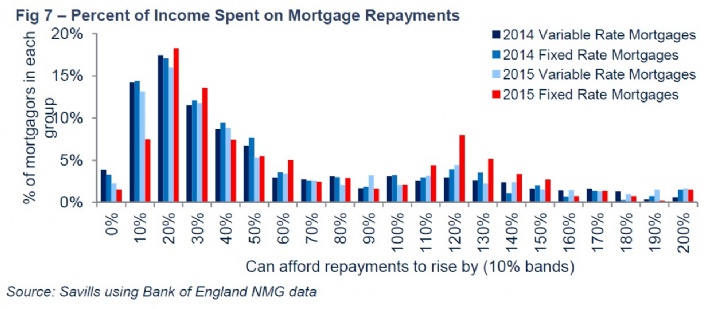

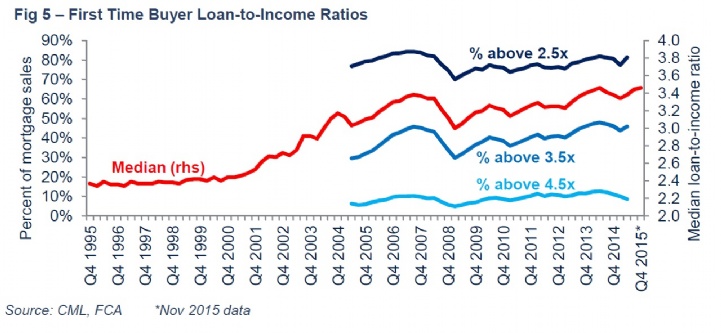

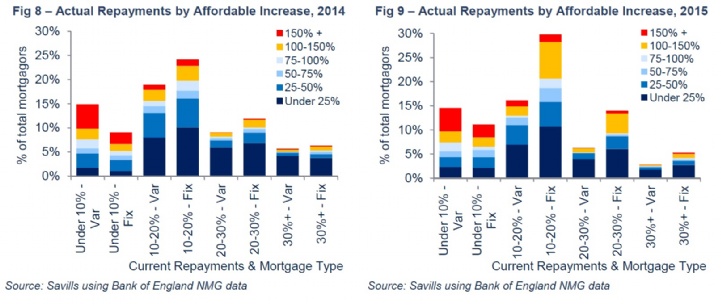

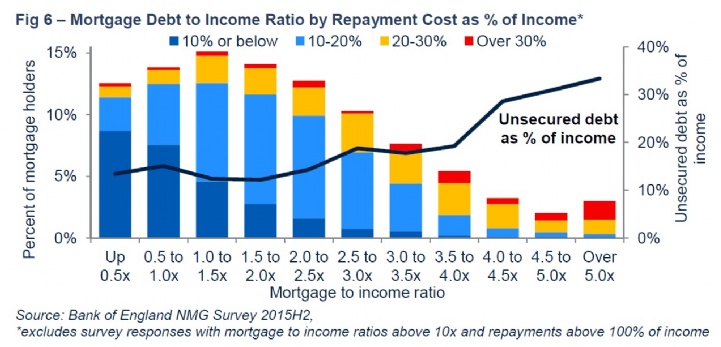

Savills Household Debt

Savills Household Debt

Savills Household Debt

What Is The Debt Payment To Income Ratio Quora

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

Savills Household Debt

.jpg)

Savills Household Debt

Home Sweet No Home For Gen Y

Savills Household Debt

What Is The Debt Payment To Income Ratio Quora

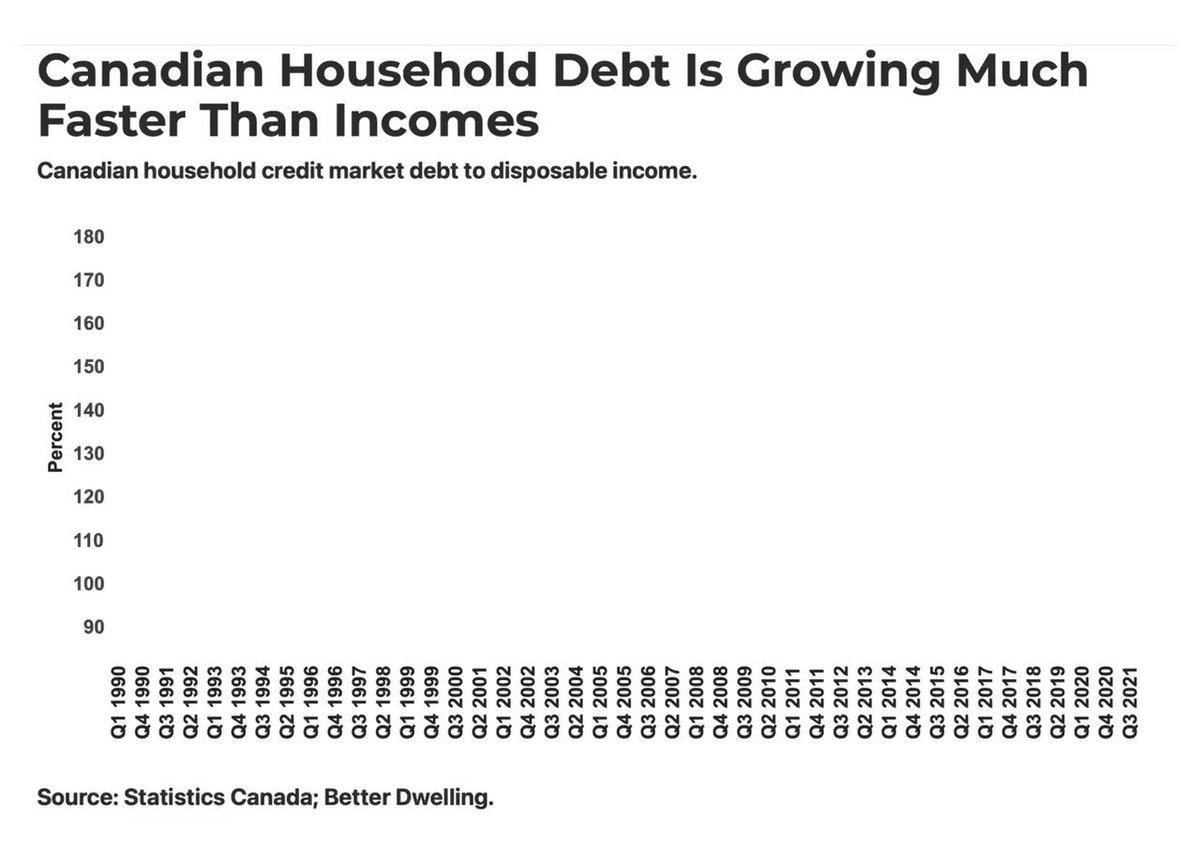

Canadian Household Debt To Income Ties Record Bigger Economic Drag This Time Better Dwelling

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

When Banks Evaluate My Debt To Income Ratio Is Income Accounted For The Gross Revenue I Bring In From Work Or Net Income After All My Living Expenses Quora

U S Mortgage Delinquency Rate 2000 2022 Statista

Canadian Household Debt To Income Ties Record Bigger Economic Drag This Time Royal York Property Management

Canadian Household Debt To Income Ties Record Bigger Economic Drag This Time Better Dwelling

.jpg)

Savills Household Debt